Portrait

GANÉ is an event-oriented value investor

We invest in winners. It means that we invest in strong companies with sustainable business models, solid balance sheets and high margins, which allows them to create added value for their shareholders. Moreover, we are guided by the Value philosophy, which is based on the specific analysis of companies’ quality and fundamental data. Based on long-term considerations, quality and fundamental data will prevail, i.e. over a specific period of time, stock prices will reflect the intrinsic value of a company.

We keep risks low and invest only when our commitment is inspired by a positive event. This is what we call the combination of Value and Event. When positive events as well as co-occurring low risk are present, this condition offers the opportunity to discover mispricing and take advantage of this situation. In doing so, we regard the realisation period as an important factor influencing the rate of return. We attach great importance to the principle of capital preservation and to the highest possible margin of safety as the difference between intrinsic value and market price.

Name

GANÉ is a neologism

The concept GANÉ cannot be found in any encyclopaedia. It is a neologism that we have derived from the Indian notion Ganesha. Ganesha is revered as Lord of the beginning and as God of intellect and wisdom. Most Indian businessmen consider him their patron. He is honoured at the beginning of each ritual. According to our interpretation, GANÉ stands for developing and implementing investment ideas based on rationality and experience.

Management

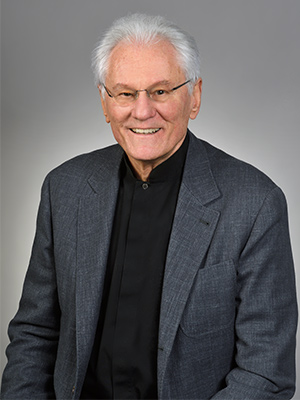

Dr. Uwe Rathausky

Dr. Uwe Rathausky was born in 1976 and studied economics at the University of Hohenheim. During his studies he worked as an analyst for Capital Management Wolpers GmbH in Pullach and Dr. Jens Erhardt Kapital AG in Pullach. In 2007 he received his doctorate for his thesis on “Squeeze-out in the area of conflict between company value and the participation of minority shareholders” from Dr. Dirk Hachmeister at the Chair of Accounting and Finance at the University of Hohenheim. In the years from 2003 to 2007, Dr. Uwe Rathausky was audit manager and a staff member in the field of ‘Audit Commercial Clients’ for KPMG AG Wirtschaftsprüfungsgesellschaft in Stuttgart. During this time he was involved primarily in the audit of financial statements and consolidated financial statements in accordance with national and international accounting standards. Dr. Uwe Rathausky is company co-founder and has been a member of the board of management of GANÉ Aktiengesellschaft since the founding of the company in 2007. He is also managing partner of GANÉ Advisory GmbH, Gräfelfing, and a member of the board of GANÉ-Investment AG mit Teilgesellschaftsvermögen, Frankfurt am Main. In 2019 the the jury of Finanzen Verlag named him “Germany’s Fund Manager of the Year” together with J. Henrik Muhle. Dr. Uwe Rathausky is married with two children.

Dr. Uwe Rathausky is a member of the supervisory board of ProfitlichSchmidlin AG.

J. Henrik Muhle

J. Henrik Muhle was born in 1975. While studying economics at the University of Hannover, he worked as an analyst for Dr. Jens Erhardt Kapital AG in Pullach. From 2002 through 2007, J. Henrik Muhle worked as an investment analyst and fund manager for ACATIS Investment GmbH, Frankfurt am Main. J. Henrik Muhle is company co-founder and has been a member of the board of management of GANÉ Aktiengesellschaft since the founding of the company in 2007. He is also managing partner of GANÉ Advisory GmbH, Gräfelfing, and a member of the board of GANÉ-Investment AG mit Teilgesellschaftsvermögen, Frankfurt am Main. In 2019 the the jury of Finanzen Verlag named him “Germany’s Fund Manager of the Year” together with Dr. Uwe Rathausky. J. Henrik Muhle is married with three children.

Capital Markets Strategist

Marcus Hüttinger

Marcus Hüttinger, born in 1981, studied International Business at Aston Business School, Birmingham, England. Between 2014 and 2019 he worked at Goldman Sachs. There, Mr Hüttinger most recently headed the Equity/Multi Asset Sales Team and the Equity Execution Team for institutional clients in Germany and Austria. He coordinated the sale of global capital market transactions, organised numerous corporate and investor events as well as senior roundtables with board members and was a core part of the organisation team of the prestigious “Goldman Sachs Global Strategy Conference” in Frankfurt. As an established expert in his field, he was in direct dialogue with decision-makers in asset management in Germany and made his capital market assessments available to numerous institutional investors on a daily basis. Prior to joining Goldman Sachs he spent over eight years with Morgan Stanley in Frankfurt and London. Since 1 January 2020 Marcus Hüttinger is capital markets strategist of GANÉ Aktiengesellschaft, managing partner of GANÉ Advisory GmbH, Gräfelfing, and a member of the board of GANÉ-Investment AG mit Teilgesellschaftsvermögen, Frankfurt am Main. In 2020, he was appointed to the FDP’s Economic Forum by Christian Lindner. Marcus Hüttinger is married and has two children.

Board

Norbert Freisleben

Chairman of the Supervisory Board

Norbert Freisleben was until June 2021 assistant manager of KPMG AG Wirtschaftsprüfungsgesellschaft, Stuttgart. He studied economics and law as a scholarship holder of the ‘Studienstiftung des Deutschen Volkes’ at the University Hohenheim and at the Graduate School of Management Aarhus, Denmark, including longer stays abroad in the USA, France and Australia. In 1998, Norbert Freisleben took the exam to become a US-Certified Public Accountant in the USA. Since then he has been a member of the American Institute of Certified Public Accountants (AICPA). He has published numerous professional and book articles with a thematic focus on national and international accounting standards and auditing. Additionally he works as an author for the ‘Münchener Kommentar zum Bilanzrecht’. Norbert Freisleben advises and trains companies, associations and auditing firms in the area of national and international accounting and auditing. He is a lecturer at the Academy for International Accounting in Cologne (Akademie für Internationale Rechnungslegung), at Pforzheim University and the Baden-Württemberg Cooperative State University in Karlsruhe (Baden-Württembergische Genossenschaftsakademie). He has also been active for many years in Germany and abroad as a lecturer in accounting under IAS/IFRS and US GAAP.

Norbert Freisleben has been a member of the supervisory board of GRENKE AG since July 2021.

Achim Josefy

Vice-Chairman of the Supervisory Board

Achim Josefy is company founder of SAP SI AG, which was created in 2000 by the merger of SAP Solutions GmbH, Freiberg am Neckar, SRS AG, Dresden, and SAP Systems Integration GmbH. The partners of SAP Solutions GmbH were Achim Josefy and SAP AG based in Walldorf. SAP Solutions GmbH arose from TOS GmbH, a technology, organisation and software development company which was founded in 1980 by Achim Josefy. At that time, Achim Josefy knew of the rather small SAP AG, which had around eighty employees at the time, through mutual cooperation with its founder and former business manager, Dietmar Hopp.

Klaus Meder

Member of the Supervisory Board

Klaus Meder is President und Representative Director of Bosch Corporation, Tokyo-Shibuya, Japan. He is responsible for the activities of Robert Bosch GmbH in Asia. Klaus Meder studied electrical engineering at the University of Technology in Darmstadt. After his graduation in 1897, he started working as a development engineer for Robert Bosch GmbH in Schwieberdingen. From 1992 through 1996 he worked as group manager for the development of restrain systems control units and as director for airbag control units. From 1996 to 2001 Klaus Meder worked as Vice President for Airbag Systems Corporation in Tomioka, Japan. In 2001 Klaus Meder became Vice President in the field of the development of electrical breaking control systems before becoming Executive Vice-President in the field of Engineering Chassis Systems Control in 2005. In 2011 he became Executive Vice President for Engineering and joined the Executive Management Board for Automotive Electronics of Robert Bosch GmbH. There he was responsible for the business segment Automotive Electronics headquartered in Reutlingen, including 30,000 employees. In 2017 he was appointed President und Representative Director of Bosch Corporation, Japan.

Klaus Meder is member of several supervisory boards in the group companies of Robert Bosch GmbH.

History

The story of GANÉ Aktiengesellschaft began in the year 2000, when Dr. Uwe Rathausky and Henrik Muhle met during an internship at Dr. Jens Ehrhardt Kapital AG in Pullach, Germany. Learn more about the milestones in the company’s development with a few photos and some amusing anecdotes. We hope you find it an enjoyable read.